Loan Calculator: Estimate Monthly Payments & Interest Easily

A loan calculator is a digital tool that helps borrowers estimate their monthly payments, total interest costs, and repayment schedule for various types of loans. By inputting key details such as loan amount, interest rate, and loan term, users can instantly generate a repayment plan to make informed financial decisions.

Key Functions of a Loan Calculator:

-

Estimates Monthly Payments – Shows how much you need to pay each month.

-

Calculates Total Interest – Reveals the overall cost of borrowing.

-

Generates Amortization Schedule – Breaks down how much of each payment goes toward principal vs. interest.

-

Compares Loan Options – Helps evaluate different loan terms and interest rates.

2. How Does a Loan Calculator Work?

Loan calculators use a mathematical formula to determine repayment amounts. The most common formula is the amortization formula:

Monthly Payment=P×r×(1+r)n(1+r)n−1

Where:

-

P = Principal loan amount

-

r = Monthly interest rate (Annual Rate ÷ 12)

-

n = Total number of payments (Loan Term in months)

Example Calculation:

-

Loan Amount (P): $20,000

-

Annual Interest Rate: 6% (Monthly Rate = 0.5%)

-

Loan Term: 5 years (60 months)

Using the formula:

-

Monthly Payment = $386.66

-

Total Interest Paid = $3,199.36

3. Types of Loan Calculators

| Type | Purpose | Key Features |

|---|---|---|

| Mortgage Calculator | Estimates home loan payments | Includes taxes, insurance, PMI |

| Auto Loan Calculator | Calculates car loan payments | Factors in down payment, trade-in value |

| Personal Loan Calculator | Determines unsecured loan payments | Compares fixed vs. variable rates |

| Student Loan Calculator | Plans education loan repayments | Estimates forgiveness options |

| Business Loan Calculator | Forecasts business financing costs | Analyzes cash flow impact |

4. Benefits of Using a Loan Calculator

✅ Financial Planning – Helps budget monthly expenses.

✅ Interest Savings – Shows how extra payments reduce total interest.

✅ Loan Comparison – Evaluates different loan terms and lenders.

✅ Avoids Surprises – Prevents unexpected repayment burdens.

✅ Time-Saving – Instantly computes complex amortization schedules.

5. How to Use a Loan Calculator Effectively

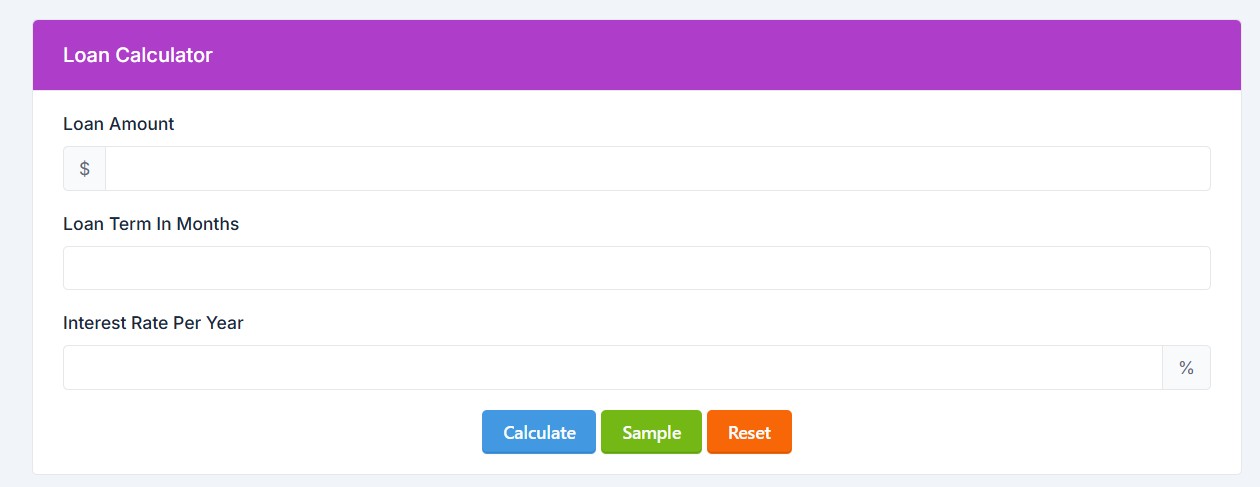

Step 1: Enter Loan Details

-

Loan Amount – The total sum you wish to borrow.

-

Interest Rate – The annual percentage rate (APR).

-

Loan Term – Repayment duration (e.g., 3 years, 15 years).

Step 2: Adjust Optional Parameters (If Available)

-

Down Payment (for auto/mortgage loans).

-

Extra Monthly Payments (to reduce interest).

-

Fees & Taxes (for accurate mortgage estimates).

Step 3: Analyze Results

-

Check monthly payment affordability.

-

Review total interest paid over the loan term.

-

Examine amortization schedule for payment breakdown.

6. Common Mistakes to Avoid

❌ Ignoring Fees & Taxes – Some loans (like mortgages) include extra costs.

❌ Underestimating Interest Impact – Small rate changes significantly affect total cost.

❌ Choosing Unaffordable Terms – Longer terms reduce monthly payments but increase interest.

❌ Not Comparing Lenders – Always check multiple loan offers before deciding.

7. Frequently Asked Questions (FAQs)

Q1: Is a loan calculator accurate?

Yes, if correct inputs are used. However, final loan terms may vary slightly based on lender policies.

Q2: Can I use a loan calculator for refinancing?

Absolutely! It helps compare current vs. new loan terms.

Q3: Does a loan calculator affect my credit score?

No, it’s just a simulation tool and doesn’t involve credit checks.

Q4: How do extra payments impact my loan?

They reduce principal faster, cutting total interest and shortening the loan term.

Q5: Are loan calculators free?

Yes, most online loan calculators are free to use.2